Building a Pitch Deck

Crafting a Winning Pitch Deck

Why You Need a Pitch Deck

What is a Pitch Deck?

A pitch deck is your startup's first impression on potential investors—a concise, visual presentation that communicates your business idea, strategy, and growth potential. In today's competitive market, a strong pitch deck is essential to capture interest and effectively convey the value of your product.

It explains the core elements of your business: the problem you’re solving, the solution you offer, and the market opportunity. It is designed to build excitement and confidence in your startup's vision and strategy.

What Does a Pitch Deck Accomplish?

A well-structured pitch deck significantly boosts your chances of securing the funding your startup needs. It not only presents critical information but also serves as a storytelling tool that conveys your passion, vision, and the unique value of your business. By guiding investors through your startup’s journey, a pitch deck helps build a compelling case for why they should believe in your idea.

Moreover, it acts as a bridge between your knowledge and an investor's understanding, turning complex ideas into a relatable and exciting narrative.

Steps to Building a Pitch Deck

In "Pitch Anything," Oren Klaff introduces the concept of two brain systems: the reptilian brain and the neocortex. The reptilian brain is primitive and focuses on survival, scanning for threats and opportunities, while the neocortex is responsible for higher-level thinking, like analysis and problem-solving.

When pitching, it's essential to first engage the reptilian brain with simple, clear, and emotionally charged messages, before addressing the more complex reasoning processes of the neocortex. This approach ensures that your audience stays attentive and invested in what you're presenting.

To that end, there isn't a specific number of slides your deck must be. Appeal to the reptilian brain, then appeal to the neocortex, then close. However many slides that requires is how long your presentation should be!

Below, we'll review the major "movements" of a typical pitch deck. As we review each, remember that your slides may not match, and you may need more than one for many of these sections.

If you're having trouble getting started you can find great templates at pitch.com and Canva.

1. The Title Slide

The title slide is the first thing your audience will see, making it crucial to capture their attention immediately. Keep in mind the reptilian brain! Use minimal text—just your company name, logo, and a concise tagline that evokes curiosity and urgency. Visual elements should be striking but not overwhelming, signaling to investors that what follows will be both straightforward and compelling.

Incorporating this primal appeal means avoiding overly complex language and focusing on creating a sense of familiarity and safety. The goal is to reduce cognitive load, allowing your audience to process the information quickly and feel intrigued, setting the stage for the rest of the presentation.

2. The Problem Statement

The problem statement is where you capture your audience's attention by clearly defining the market gap your product addresses. According to Klaff’s approach, appealing to the reptilian brain requires simplicity and urgency. Investors need to understand the problem quickly, so present it in a straightforward, relatable manner, avoiding complex jargon.

Frame the problem in a way that resonates emotionally. Show the severity of the issue and how it affects people or businesses. This primes the audience to be more receptive to the solution you’ll present next, tapping into both the primal and rational parts of their thinking.

3. The Solution

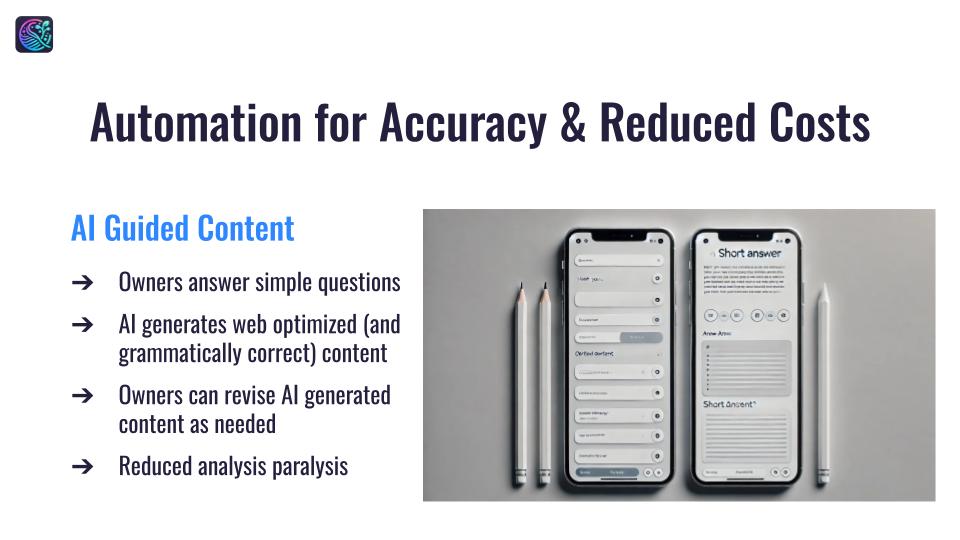

Once you've established the problem, it's time to showcase your solution. This slide is critical because it demonstrates how your product or service addresses the specific problem you just defined. According to Klaff, the reptilian brain still needs engagement here. You should keep the solution clear, tangible, and easy to understand without overwhelming the audience with details.

A great way to appeal to both the emotional and logical parts of the brain is to include visuals, such as screenshots, videos, or diagrams that highlight your product’s core features. Show, rather than tell, how your solution stands out. By presenting your solution visually, you make it easier for investors to grasp and remember it. This keeps their attention and primes them to want to hear more about how your business will succeed.

4. Market Fit

5. Business Model

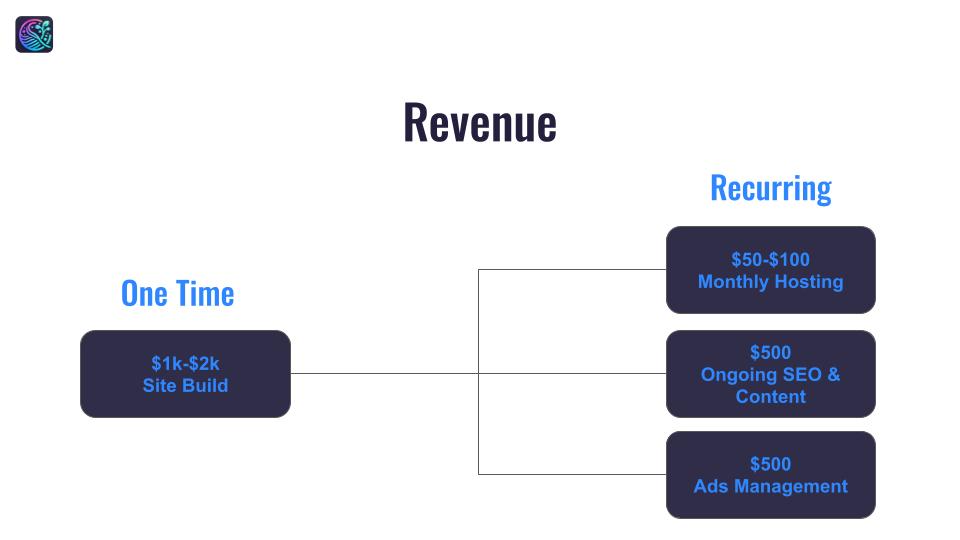

The Business Model slide is where you explain how your company generates revenue and ensures long-term sustainability. This is the section to outline your pricing structure, whether it's subscription-based, one-time purchases, or a freemium model. You might offer tiered pricing for different customer segments or add-ons that increase the value of your product or service. Clearly show how your business model aligns with your target market and the problem you're solving.

Investors want to know not only how you're solving a problem but also how you're creating consistent revenue streams. Highlight key metrics such as customer acquisition costs, profit margins, and lifetime customer value. Additionally, show how your business model scales as demand grows, whether through market expansion, upselling opportunities, or strategic partnerships. A well-defined business model demonstrates that you have a clear path to profitability, which is essential for gaining investor confidence.

6. Demonstrate Traction

In the Traction and Milestones slide, showcase key metrics that demonstrate your business’s growth and progress to date. This might include data on user acquisition, revenue generation, or customer feedback.

Highlight significant milestones such as product launches, partnership deals, or reaching a certain number of active users. However, be mindful of the balance between ambition and realism. Some founders may push for aggressive milestones to impress investors, but overpromising can damage credibility if expectations aren't met. Instead, focus on realistic goals that showcase your ability to execute and deliver results consistently.

This can also be an excellent place to focus on projections for revenue. Again, be mindful of setting realistic expectations. Often a range with supporting data can go a long way in showing investors that you've done your homework.

7. Team Overview

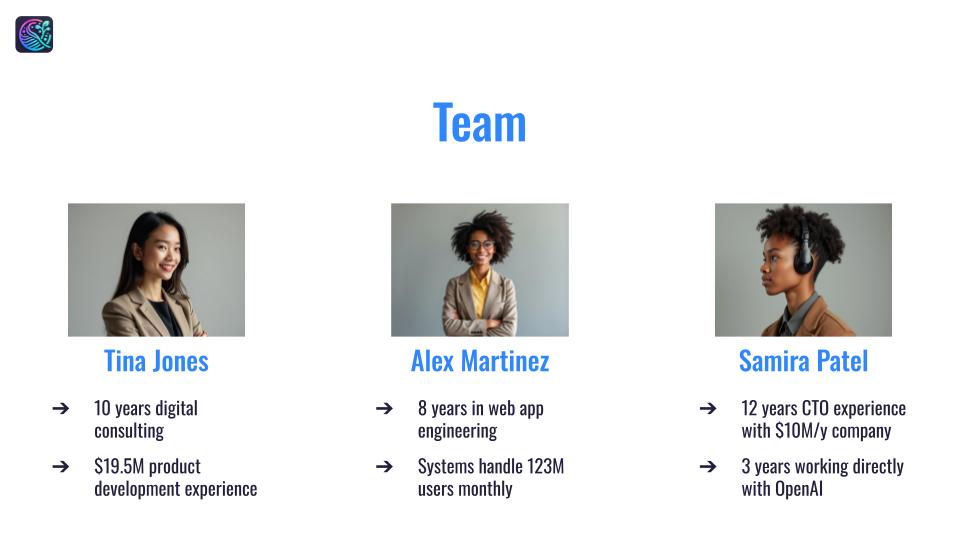

The Team Overview slide introduces the key players behind your company and highlights their experience, expertise, and the value they bring to the business. If your team includes seasoned entrepreneurs or industry experts, it can be a powerful confidence booster for investors. Depending on your company’s stage, some experts recommend moving this slide earlier in the pitch if the team is one of your strongest assets.

Pros: Highlighting a strong team early can build investor trust in your ability to execute the business plan. Investors often believe that a great team can pivot and adapt, even if the initial strategy needs adjustments.

Cons: For some investors, market fit and product viability take precedence over the team’s credentials, meaning the focus on the team may not be as persuasive in the early slides. Be sure to balance the team’s story with the market opportunity.

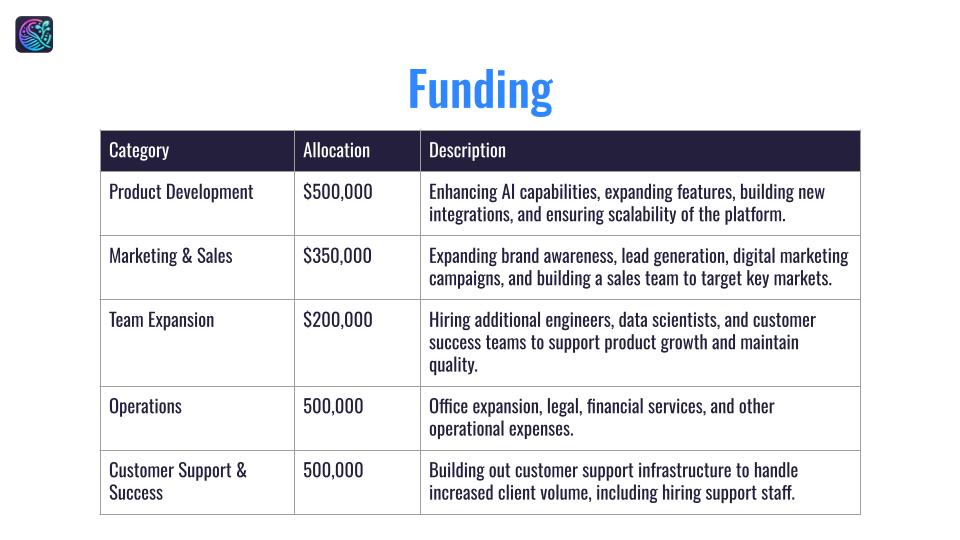

8. Funding

The Funding Requirements slide is crucial for clearly communicating how much capital you need and exactly how it will be used. This slide should provide a precise breakdown of the funding request, linking each amount to specific business activities such as product development, marketing, team expansion, or operational scaling. Investors want to see that you’ve carefully thought through how their money will be allocated and how it will fuel growth, so clarity and detail are key.

Begin by stating the total amount of funding you are seeking, then break it down into major categories, such as 40% for product development, 30% for marketing, 20% for hiring, and 10% for operational costs. Accompany this breakdown with a timeline, showing when you expect to deploy the capital and the key milestones that this investment will help you achieve.

By providing this level of detail, you demonstrate to investors that you have a solid financial plan and a clear understanding of how to maximize their investment. Make sure your request aligns with the projected growth and scalability of your business to enhance investor confidence.

9. Closing

The Closing Slide is your final opportunity to leave a lasting impression on potential investors. Keep it simple and professional, reinforcing your message and making it easy for them to follow up. Start with a brief thank-you note to express appreciation for their time and consideration. This adds a personal touch and closes the presentation on a positive, respectful note.

Be sure to include key contact information, such as your email address, phone number, and possibly LinkedIn profiles of key team members. You may also want to restate a compelling fact or short tagline about your company to reinforce your value proposition. Avoid overloading this slide with information—keep the focus on making the next steps clear and actionable. A concise and confident closing helps ensure you stay top of mind as investors evaluate their options.

Help Getting Started

The Actuator program at BRIC offers entrepreneurs an intensive 8-week curriculum to help prepare their businesses for success, including creating a solid pitch. Participants receive guidance from mentors, subject matter experts, and workshops to refine their business models and presentation skills. The program culminates in a Pitch Night, where founders showcase their progress and pitch their business ideas to potential investors and industry leaders, giving them a chance to secure valuable support and feedback.

If you’re ready to take the next step, explore our Actuator program and discover the full range of resources, mentorship, and opportunities available to tech entrepreneurs in Vermont. Let’s build something extraordinary together!